Thinking about an Adjustable-Rate Mortgage? Read This First.

If you’ve been house hunting lately, you’ve probably felt the sting of today’s mortgage rates. And it’s because of those rates and rising home prices that many homebuyers are starting to explore other types of loans to make the numbers work. And one option that’s...

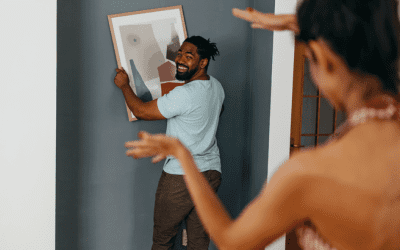

Weekend Projects To Boost the Value of Your Home

With the cost of just about everything going up these days — groceries, gas and utilities — you might be feeling like now just isn’t the time to take on any home projects. But remember, you don’t need to tackle a full-on renovation to make a big impact.And if you...

What Happens to the Housing Market When the Economy Slows Down?

There’s a lot of noise out there about what an economic slowdown could mean for the housing market. And if it leaves you feeling a little uneasy, you’re not alone. But here’s the thing.If you’re worried about what a potential recession could mean for the value of your...

Why Now Could Be the Sweet Spot for Sellers

Over the past year, a lot of people put their moving plans on hold. Affordability weakened, and it was harder to find a home in budget, especially when inventory was so low. But things are shifting in a big way. Today, a rare balance is emerging — more choices when...

What Waiting To Buy Could Cost You

A lot of people want to buy a home, but they feel stuck in “wait and see” mode. Maybe you’re one of them. You’re holding your breath, hoping prices will fall or rates will come back down. But while you’re waiting, the market is moving — without you.The reality is,...

More Homes for Sale Isn’t a Warning Sign – It’s Your Buying Opportunity

Maybe you’ve heard the number of homes for sale has reached a recent high. And it might make you question if this is the start of another housing market crash.But the reality is, the data proves that’s just not the case. In most areas, more inventory isn’t bad news....

What Buyers Need To Know About Homeowners Association Fees

When buying a home, you’re probably thinking about mortgage rates, home prices, your down payment, and maybe even your closing costs. But you may not be thinking about homeowners association (HOA) fees. While you won’t necessarily have these, you should know it’s a...

You Could Use Some of Your Equity To Give Your Children the Gift of Home

If you’re a homeowner, chances are you’ve built up a lot of wealth – just by living in your house and watching its value grow over time. And that equity? It’s something that could help change your child’s life.Since affordability is still a challenge, a lot of...

Housing Market Forecasts for the Second Half of 2025

Some HighlightsAre you wondering what to expect if you buy or sell a home in the second half of the year? Here’s what the expert forecasts tell you.Mortgage rates are expected to come down slightly. There will be more homes available for sale. And as inventory rises,...

Why Would I Move with a 3% Mortgage Rate?

If you have a 3% mortgage rate, you’re probably pretty hesitant to let that go. And even if you’ve toyed with the idea of moving, this nagging thought may be holding you back: “why would I give that up?”But when you ask that question, you may be putting your needs on...